Avoid Claims

Reduce Premiums

Increase Profit

As Certified Risk Managers, our specialized employee testing platform allows you to quickly & easily identify potentially high-risk employees who may have a propensity to cause workers compensation and auto claims. Validated by over 30 years of university research, our proven, easy-to-use online employee testing can reduce your insurance claims, claim severity and premiums. This helps increase your business’ profitability and employee performance.

Lower Insurance Premiums

with Real, Measurable Results

71% REDUCTION

in workers comp claim severity

17% REDUCTION

in auto accident claims

62% REDUCTION

in unexcused absences

83% LOWER

employee turnover

Our Solutions

PREDICTIVE BEHAVIOR PROFILE™

Identify High-Risk Employees

The Predictive Behavior Profile is a pre-employment personality assessment designed to identify high-risk candidates before making a hiring decision.

What It Does

It identifies applying candidates with personality traits that can/may have a negative impact on job performance, auto accidents, workers’ compensation claims, unexcused absences and turnover.

How You Benefit

By hiring superior employees, you can reduce your company’s perceived risk and liability insurance costs, as well as reduce frequency and severity of workers’ compensation and automobile claims while ensuring a quality work force.

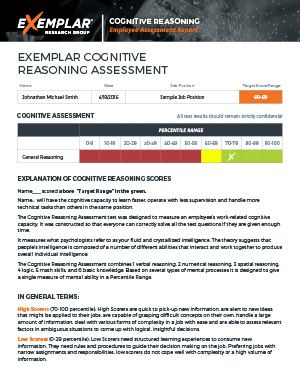

COGNITIVE APTITUDE ASSESSMENT™

Identify High-Performing Employees

The Cognitive Aptitude Assessment is a mental evaluation designed that uses predictive analytics to identify high-performing employees for hiring and promoting employees.

What It does

This assessment measuring verbal reasoning, numerical reasoning, spatial reasoning, logic, basic math skills and basic knowledge. It identifies the candidates’ s strengths and developmental opportunities by measuring their fluid or crystallized intelligence. The employer can manually adjust the setting (average score range) to the specific job they are hiring for.

How You Benefit

By promoting and hiring employees who are more likely to successful for a job position, you can help to ensure that the best people are being placed in the best position for leadership, productivity and efficiency while safeguarding company culture and standards.

Documentation

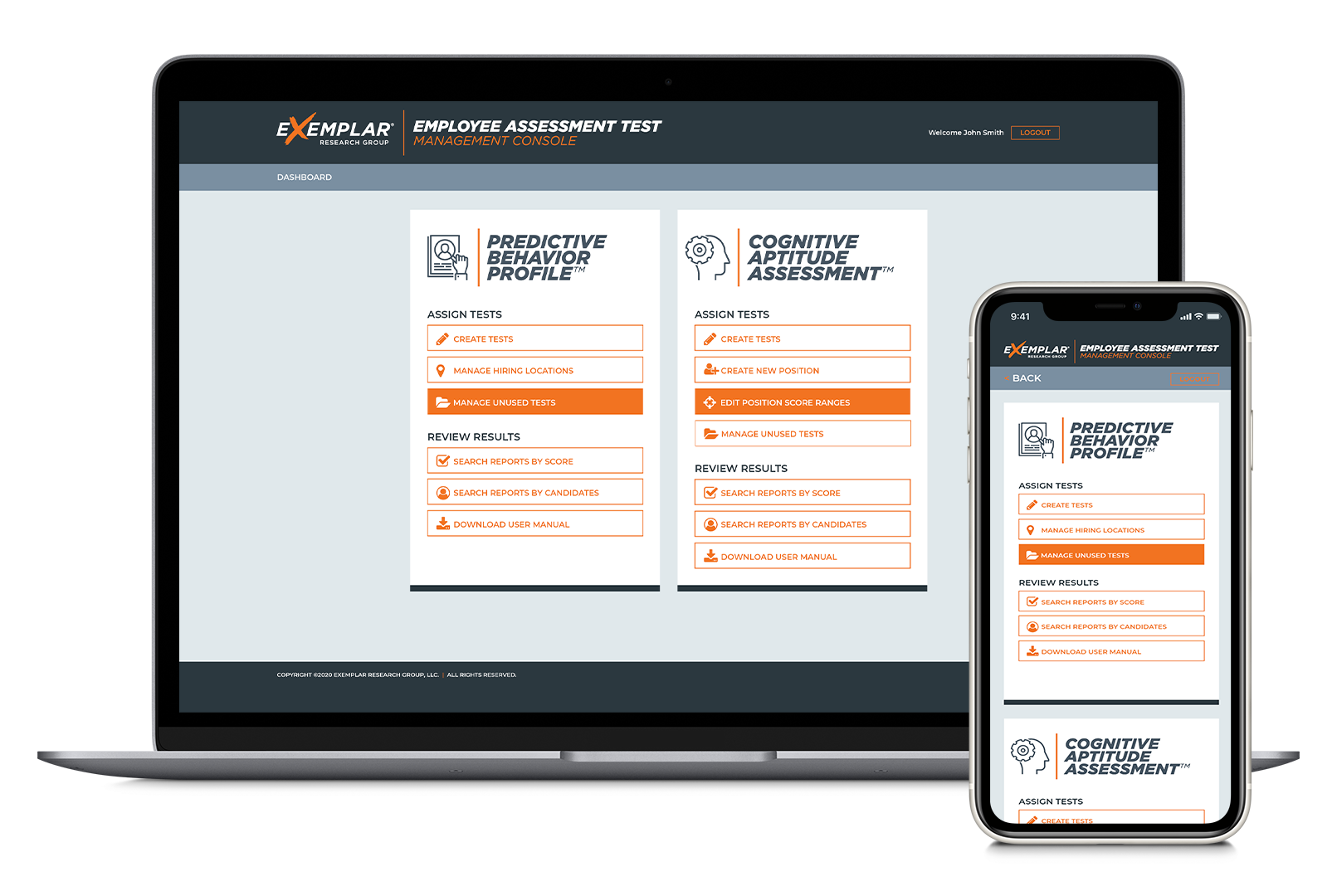

Exemplar test Management Console

Streamline Employee Testing

Your business gets access to the Exemplar online testing platform to manage every aspect of your employee testing and evaluation from one, easy-to-use dashboard.

- Online, cloud-based dashboard allowing access anywhere

- Assign, create and send tests to one or multiple candidates at a time

- Set target score ranges per position and manage unused tests

- Tests may be set to measure for retention of permanent or seasonal positions

- Manage testing for single or multiple hiring locations

- Candidates can take tests in-person or remotely with automated emails including a link to take their test

ARE YOU AN INSURANCE AGENT?

Debbie Sand Canfor Lumber

“Using Exemplar Research Groups Predictive Behavior Profile™ has given Orbis Holding Group a clear advantage over our competition. Our clients often seek out our services because they have struggled with workers compensation claims.”

Amy Wentrack Orbis Holding Group

“I estimate that we have reduced our cost of risk by $263,000 annually using The Predictive Behavior Profile™. The results are unbelievable, our worker’s comp severity costs plummeted by 68.9% over the last 18 months.”

F. Vezzetti Richfield Management

Our Purpose

We strive to give companies the tools they need to reduce their risk to an insurance company. Insurance Companies recognize that companies who have less risk and lower claims also deserve lower premiums.

25 YEARS

of validated research

20 MINUTES

to complete the personality survey

30 SECONDS

to see the test results

GET THE EDGE OVER YOUR COMPETITION

Pay less for your workers compensation and auto insurance. Your insurance premiums are based on the real and perceived risk of claims you pose to your insurance carrier and one of the greatest risk you have is your own employees. Here is why, companies don’t have accidents only employees can have an accident. By actively avoiding high risk employees the lower your claims and premiums will be.

HOW HIGH RISK EMPLOYEES AFFECT YOUR COMPANY

Claims gives the carrier a justifiable reason to increase your insurance premiums

It targets you for lawsuits, OSHA and The Department of labor scrutiny

Workers comp claims increases your experience modification driving up premiums

IDENTIFY AND AVOID HIGH-RISK HIGH-COST EMPLOYEES

Exemplar Research Group has developed the one and only personality survey that has criterion- validation to reduce workers compensation claim severity and future driving infractions.

GET STARTED FOR FREE

Sign up today for a free 30 day trial with zero commitment, or call us for a consultation we would love to hear your story.